Summer is here and, as usual, Oklahoma teenagers are glad to have a break from school. Usually, teenagers find summer jobs to pay for short-term wants such as going to Frontier City or to the movies. Naturally, most teens will not be interested in saving their money for the long term, but the potential rewards of doing so are enormous. Teenagers have a unique investment advantage that isn’t available to most people working. That advantage is time.

Most teens will find the best vehicle to use for investing their money is a Roth IRA because it offers a favorable tax break. Although there is no upfront tax deduction, the earnings and contributions will grow tax-free forever. This provides a better tax advantage for teenagers because when they are older, they’ll likely move into a higher tax bracket.

A Roth IRA is potentially a form of tax arbitrage. Your teen is likely in the 10% tax bracket right now and let’s project they will move into the 24% tax bracket in the future when they are older. This makes the back-end tax advantage stronger than an upfront tax advantage since paying a little tax now will save a lot more tax later.1

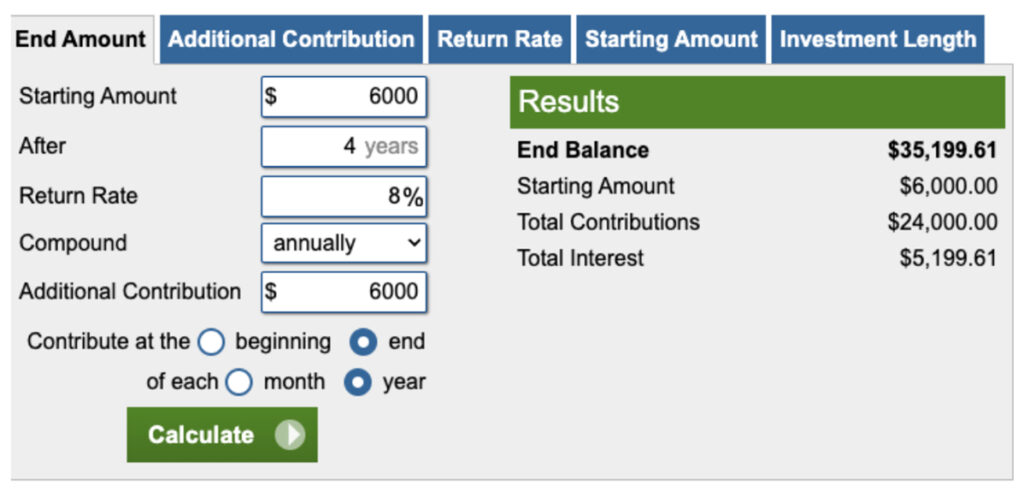

Let’s assume your teenager is 15 years old and contributes the maximum $6,000 to a Roth IRA this year as well as the next three years, through age 18, for a total of $24,000 in contributions. Let’s further assume the money will be invested in a diversified stock index fund and will earn an 8% annualized return through age 65, at which time the Roth IRA will have grown to over $1.2 million! Although an 8% return is not guaranteed, historical evidence suggests an 8% return is reasonable for stocks over a long period of time, considering the S&P 500 index has returned around 10% annualized since 1926.2

https://www.calculator.net/investment-calculator.html

This assumption demonstrates the awesome power of compounding and is the reason Albert Einstein was quoted as saying, “Compound interest is the eighth wonder of the world.” When you combine time and compounding, it is like rocket fuel for long-term investment growth.3

You may wonder if it’s a good idea to allow your teenager to manage his or her own investment account. By law, teenagers are required to hold a custodial Roth IRA in Oklahoma until age 18 because they are minors. This means the parent is in charge of managing the account until the teenager is of age. Most custodians will allow you to open a custodial Roth IRA so you should not have any issue finding a financial institution to do this for you.

What if your teen would like to spend some of his or her money on short-term goals or needs? Generally, you want to avoid withdrawing from a Roth IRA until age 59 1/2 , which is the earliest age you can withdraw funds completely tax-free. Fortunately, Roth IRAs allow you to withdraw your contributions at any time without any tax or penalty.4

Additionally, there is extra flexibility for spending on college or first-time homebuyer expenses. You can withdraw funds from a Roth IRA qualified education expenses without any 10% tax penalty, but beware there are taxes on any earnings. Additionally, you can withdraw up to $10,000 for a down payment or closing costs on a home without any penalty or tax on earnings. Make sure you consult your tax and financial advisors before taking any action with Roth IRA contributions or withdrawals.

So, as your teenager plans to make some money from summer jobs, help him or her capitalize on this unique opportunity to invest. By starting early, your teen will be set up for long-term financial success and will establish healthy financial habits at an early age.

Sources:

- https://www.bankrate.com/taxes/tax-brackets/

- https://www.investopedia.com/ask/answers/042415/what-average-annual-return-sp-500.asp

- https://www.goodreads.com/quotes/76863-compound-interest-is-the-eighth-wonder-of-the-world-he

- https://www.irs.gov/retirement-plans/roth-iras

The content of this article is developed from sources believed to provide accurate information. The information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. All expressions of opinion are subject to change. This content is distributed for informational purposes only, and is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products or services. Past performance is not a guarantee of future results. Index performance does not reflect the expenses associated with the management of an actual portfolio.