If you are investing in stocks right now, you may be concerned about what’s going on in the world and in the markets. We don’t know anyone who enjoys seeing their money go down. This feeling only makes you human.

The underlying factor of this emotion is “loss aversion,” meaning we feel the pain of loss at a much sharper level than we feel the pleasure of gains. In other words, all of us love to win, but no one enjoys the feeling of losing—and we will do almost anything to avoid that feeling. Understanding the concept of loss aversion is a key to having success on the other side of this market downturn.

What’s causing the market volatility?

The Russia-Ukraine military situation is clearly driving a lot of the headlines and worries right now. Geopolitical events like this can affect stock prices, at least temporarily. Additionally, we are dealing with the highest inflation report since the 1980s and continue to feel lingering effects from the worst pandemic in 100 years.1

One note on the Russia-Ukraine situation: it is all about energy, which is the lifeblood of Vladimir Putin’s regime. Russia supplies 40% of Europe’s heating fuel through natural gas. Apparently, one of the major pipelines that transmits natural gas runs through Ukraine. Putin wants to prevent Ukraine from potentially diverting this gas to the West, which is driving his desire to invade Ukraine.2

What will the market do next?

No one knows what will happen in the future, but there is some historical precedent for world events and their impact on markets. There is no question that certain events can shock the markets, at least in the short-term. But investors can take comfort in knowing that there has never been one single event that wrecked markets for the long-term.

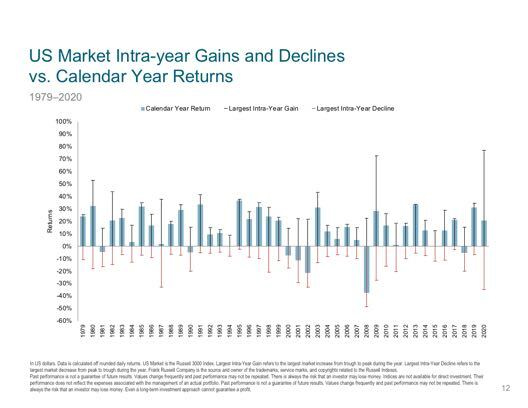

As investors, we should also remember the reason we are rewarded with higher returns in the future is because of the volatility we accept in the near-term. A drop in the market won’t destroy your investment plan—but selling at the wrong time will.

What should I do now?

Let’s put the market’s recent fluctuations in the proper perspective. There is nothing going on today that is out of the ordinary. In fact, 2021 was more of an abnormal year in that stocks continued to go up with very little resistance throughout the year. Based on history, market corrections of 10-15% are common and should be expected.

Does this mean the market will turn positive soon? Unfortunately, there is no crystal ball.

So, how do you deal with an uncertain world and market without knowing the future?

- Reflect on your long-term goals and ignore all the market forecasts, as they are worthless.

- Revisit your financial plan and make sure you are acting on the plan rather than reacting to the markets.

- If you’re still in accumulation mode, use the drop in the markets as a buying opportunity.

The four most expensive words in the economic world are “this time is different.” The so-called “experts” and “gurus” in the media will have their opinions and make their predictions. We encourage you to take note of what the late economist John Kenneth Galbraith said, “There are two kinds of forecasters: those who don’t know, and those who don’t know they don’t know.”

Stay diversified, remain disciplined, and keep working your plan. Doing so always gives you the best chance to succeed in the future.

We will get through this market downturn together. Please do not hesitate to give us a call or shoot us an e-mail if you have any questions or concerns.

Your partners in success,

Castlepoint Team

Sources

- https://www.cnbc.com/2022/02/10/january-2022-cpi-inflation-rises-7point5percent-over-the-past-year-even-more-than-expected.html

- https://www.marketwatch.com/story/im-a-former-moscow-correspondent-dont-let-vladimir-putin-fool-you-russias-war-in-ukraine-is-only-about-one-thing-11645571878

The content of this article is developed from sources believed to provide accurate information. All expressions of opinion are subject to change. This content is distributed for informational purposes only, and is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products or services. Past performance is not a guarantee of future results. Index performance does not reflect the expenses associated with the management of an actual portfolio.