Drew Garner

If you’re between the ages of 60 and 70, retired, and hold a mix of assets with varying tax characteristics, this article is especially for you. These 10 years or so — often seen as a financial “sweet spot”—can offer strategic opportunities that are well worth exploring to maximize your financial health. Being a good steward of what you have accumulated ultimately will allow you more capability to use those dollars in a manner that is fulfilling and meaningful to you and your family. Whether that is creating memories with multiple generations, donating to charities dear to your heart, or passing on a legacy

If you’re in your 60s, enjoying retirement, and have a mix of taxable, tax-deferred, and taxfree accounts, you’re in a unique spot. These years—before things like Required Minimum Distributions kick in—can be a window of real opportunity. In this article, we’ll break down what you need to know and how smart moves now could make a big difference later.

You’ve retired. You’ve saved. Now you’re looking at your accounts and wondering what the smartest next steps are. If you’re between 60 and 70, you’ve got more flexibility than you might think. This stage—right before Social Security and RMDs lock things in—is a great time to get strategic. Let’s walk through what matters most and how to think it through.

This article will shed light on some unique and often overlooked financial planning opportunities. While some of the strategies discussed may seem tailored to a niche audience, there are broader insights here that could be relevant to many readers.

There are two main reasons:

A. A breakdown of key financial planning terms and concepts relevant to the golden years of planning

B. A look at strategic techniques once those fundamentals are in place.

C. Real-world applications of these strategies, with practical examples to bring the ideas to life.

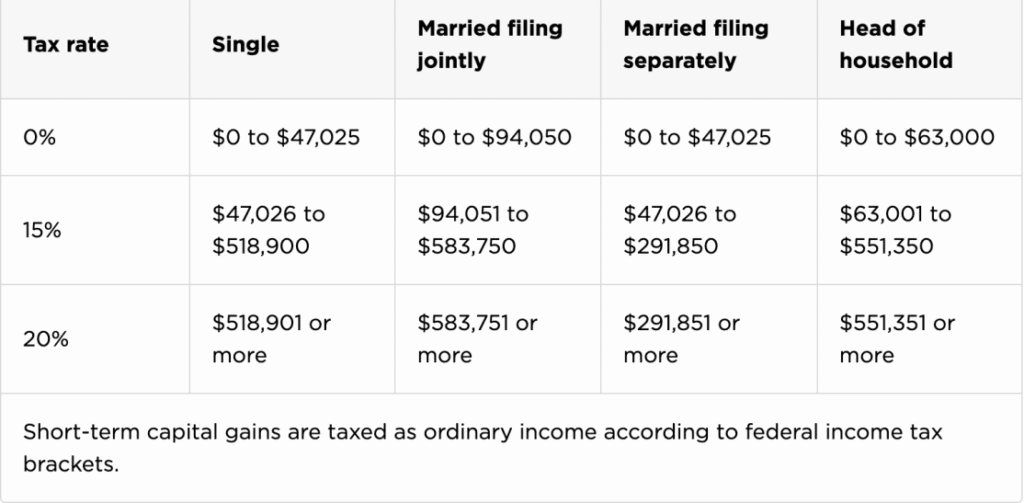

Your capital gains rate is based on your total taxable income for the year.

An RMD is the government’s way of collecting taxes on retirement savings that have grown tax-deferred. Starting at age 73, you’re required to withdraw a specific amount each year from pre-tax accounts like Traditional IRAs, Rollover IRAs, and Inherited IRAs.

Think of it this way: the government let you grow these funds tax-free for years—now they want their share. RMDs are calculated annually and taxed as ordinary income. Even if you don’t need the money, you’re required to withdraw it—and pay taxes on it.

The exact rules can change, but the key takeaway is: RMDs are unavoidable once you reach the age threshold*, and they will impact your tax bill.

1. Roth Conversions

A Roth conversion lets you move money from a Traditional IRA to a Roth IRA, intentionally recognizing income in the process. For example, converting $50,000 means you’ll report $50,000 in ordinary income for that tax year. While this triggers a tax bill now, those funds grow tax-free in the Roth—and future withdrawals are also tax-free.

Why purposefully recognize income now?

Key considerations:

2. Delaying Social Security

Social Security benefits typically start around age 66–67 when you have attained FRA (Full retirement age), but benefits can be delayed until age 70. Each year you delay benefits beyond FRA; your benefit increases roughly 8%. Delaying from 66 to 70 can result in a 30%+ increase in annual income. If you don’t need the income right away, it’s worth considering.

Key considerations:

3. Capital Gains Harvesting

In years with low taxable income, you may qualify for the 0% long-term capital gains tax rate. If so, intentionally selling appreciated assets (“harvesting gains”) can allow you to realize profits tax-free. That’s a 15%+ tax savings, just by being strategic with timing.

Key considerations:

3. Gifting Opportunities

If you are inclined to make charitable gifts, there are certain strategies that can be effective and age dependent. This is fringe related to the planning techniques above, but I want to mention it because it can have a major impact on planning. Qualified Charitable Distributions (QCD’s) and Donor Advised Funds (DAF’s) are something you should engage your financial advisor on if gifting aligns with your goals

Key considerations:

Let’s imagine you’ve just retired at age 62 with the following account balances:

Bank Account: $250,000

Joint Account: $1,500,000

Traditional IRA: $2,000,000

Roth IRA: $200,000

Your joint account includes $1M in cost basis and $500K in long-term unrealized gains.

You need $120,000/year ($10,000/month) to cover retirement expenses.

Scenario 1: Living Off Cash

In year 1, you draw from your bank account, resulting in $0 taxable income. This opens a unique window:

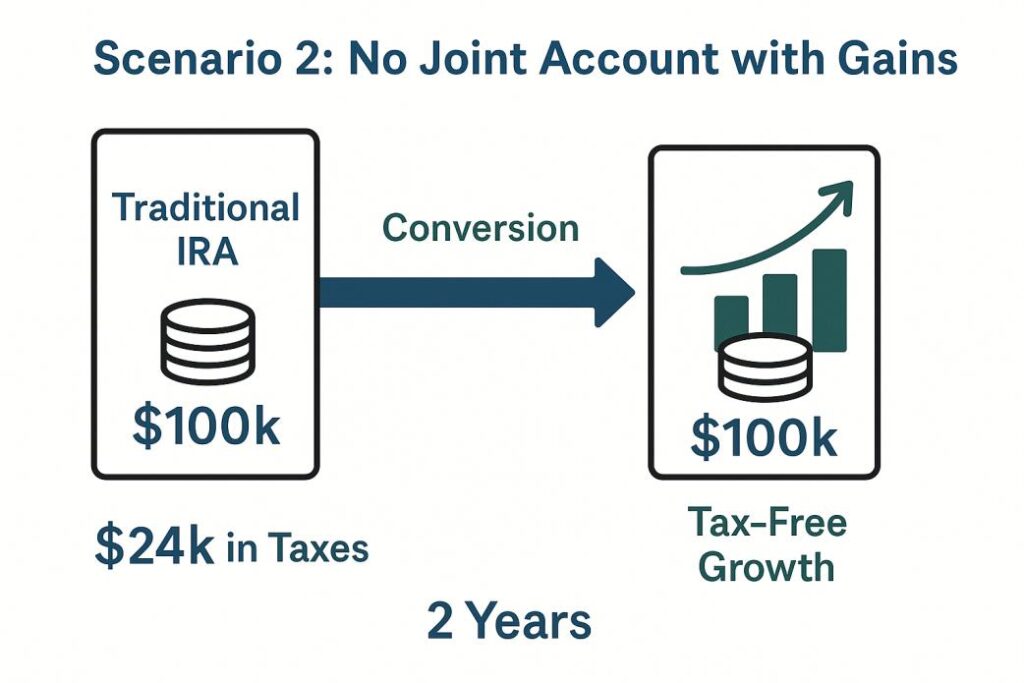

Scenario 2: No Joint Account with Gains to Recognize

If you didn’t have appreciated assets to harvest, consider a Roth conversion instead:

These early retirement years—before Required Minimum Distributions (RMDs) and social security begin—are a prime opportunity to control your income and strategically lower your lifetime tax bill. Even if large conversions aren’t feasible, smaller annual Roth conversions (e.g., $20,000/year) can lead to major long-term savings.

It’s wise to work with a trusted advisor to tailor this approach to your unique goals and income needs.

*RMD’s are unavoidable in that the distributions must occur, however there is a planning technique that allows the distribution to occur without recognizing income. This would be a Qualified Charitable Distribution, or QCD. QCD’s have certain rules and complexities involved that would need to be aligned with the clients’ goals before implementation.