Jake Weatherford

At the highest levels of leadership, retirement is not merely an exit. It’s a strategic inflection point. For executives who have built careers on foresight, decisiveness, and vision, the transition from active leadership to life beyond the C-suite requires the same precision they once applied to major corporate transformations.

This paper explores how to architect a seamless shift from peak career to peak retirement—preserving influence, legacy, and fulfillment without compromising strategic clarity or personal direction.

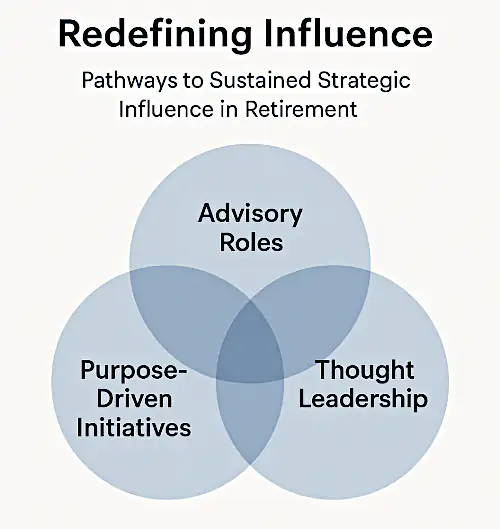

Stepping down does not mean stepping away. Executives must reframe retirement not as withdrawal, but as realignment of influence.

This next chapter is about staying engaged where impact still matters—with a blueprint that reflects values, not just valuations.

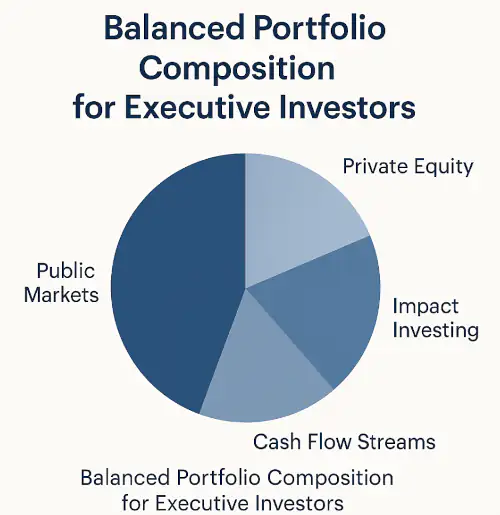

Executives are not passive investors; they require a wealth strategy that reflects their analytical mindset, forward-thinking approach, and commitment to long-term value creation.

The goal: Ensure capital performs with the same efficiency and intentionality as the executive career it underwrites.

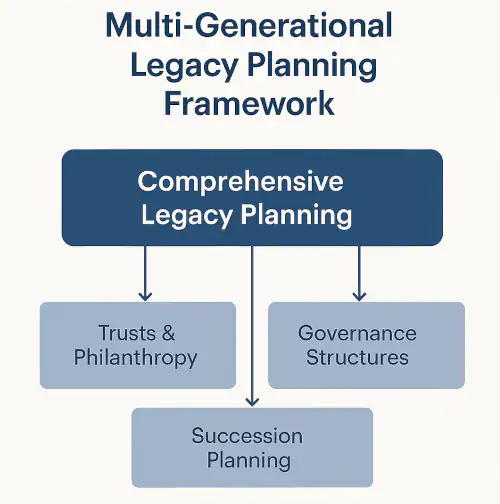

Legacy is not just about inheritance—it’s about intention. The objective is to perpetuate influence, values, and decision-making frameworks across generations.

It’s not about passing the baton; it’s about embedding vision in systems that endure.

Executives require strategic partners who understand complexity, anticipate inflection points, and offer solutions that transcend investment products.

Financial strategy must evolve into a full-spectrum advisory model that aligns with the demands of executive decision-making.

Retirement is a resource reallocation exercise: of time, capital, and attention. Executives should approach it as a redesign of how they engage with the world.

A well-executed retirement plan becomes a platform for continued relevance—on the executive’s terms.

This isn’t the end of a career. It’s the next stage of strategic influence. With a disciplined framework, executives can transition deliberately, maintain their intellectual edge, and build a legacy that lasts.

The opportunity is not to slow down—but to redirect. Not to retire from something, but to retire into something.

This paper is intended as a strategic lens for executives preparing for transition. It reflects the level of precision, scope, and insight that leadership demands when designing what comes next.