Ted Creegan

Why So Many Doctors Feel Behind—and How they Get Back on Track

“I should have started earlier.”

That phrase comes up a lot.

Sometimes it’s more colorfully stated, “I’ve worked too hard to feel a day late and dollar short.”

Other times: “I feel like I’m behind, and I’m not sure how to catch up.”

It’s not regret at all. It’s more like financial whiplash. One minute you’re in residency, the next you’re earning more than most of your peers—and trying to reverse-engineer a life around it.

You’re not alone. Most physicians feel like they got dropped into the middle of the game without reading the rules. They’re smart, capable, and making big financial decisions—often on the fly, often in silos, and often with that quiet feeling in the background:

“We should probably get more organized.”

This paper is a starting point. Not a checklist or a fix-all. Just a way to step back, look around, and see that you’re not as far off track as you might think. It isn’t whether you have a more complex setup — like a Solo 401(k) paired with a cash balance plan — or whether you simply make monthly contributions to an investment account. It’s that you have a plan, and you implement it early.

The training never really stops—not in medicine, and not in your financial life either.

But the timeline is different. In your 20s and 30s, you’re focused on exams, rotations, and surviving on a resident’s salary. Financially, it’s a holding pattern. Income is low. Debt piles up. You defer decisions because there’s just no room to make them.

Then the switch flips. Suddenly, your income triples. But no one handed you a playbook on what to do next.

So you do what you can. Maybe you max out your 401(k), put some cash in savings, get life insurance, and start chipping away at loans. You’re making progress—but without structure, it’s hard to know if it’s enough.

I often hear:

This is especially common for doctors in their 40s and 50s—the middle of career and family life, where things feel both full and fragile. Income is strong, but so are competing demands: kids, aging parents, practice decisions, burnout, and a real sense that retirement isn’t as far away as it used to be.

The reality is: you might not be behind—you might just be missing clarity.

Let’s be honest: over the counter financial advice is not built for people like you.

It’s either too generic—“Just max your retirement account”—or too product-driven—“Buy this policy or fund.” But what most physicians need is someone who can slow things down and connect the dots between what they earn and what they want their life to look like.

That starts with a different kind of conversation.

Instead of, “How much are you saving?”

It’s, “What are you working toward—and what’s getting in the way?”

Instead of, “You need to invest more.”

It’s, “Let’s understand your cash flow, taxes, and what options you actually have.”

Instead of, “You should be doing X, Y, and Z.”

It’s, “Here are three things to focus on first. We’ll get to the rest when the time’s right.”

The real value isn’t in handing you a big binder or a fancy portfolio. It’s in helping you make a few clear, well-informed decisions each year that move everything in the right direction.

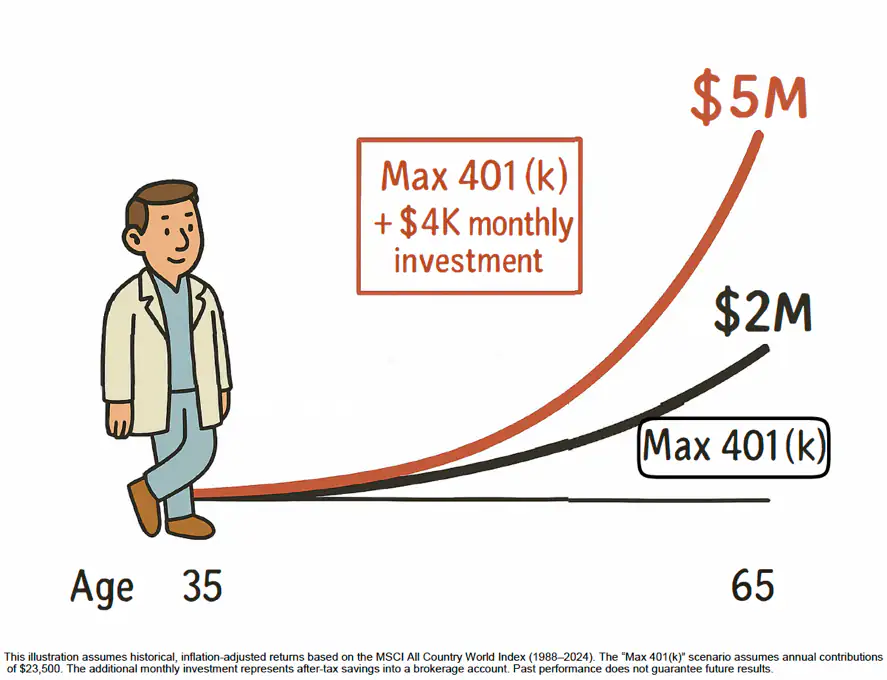

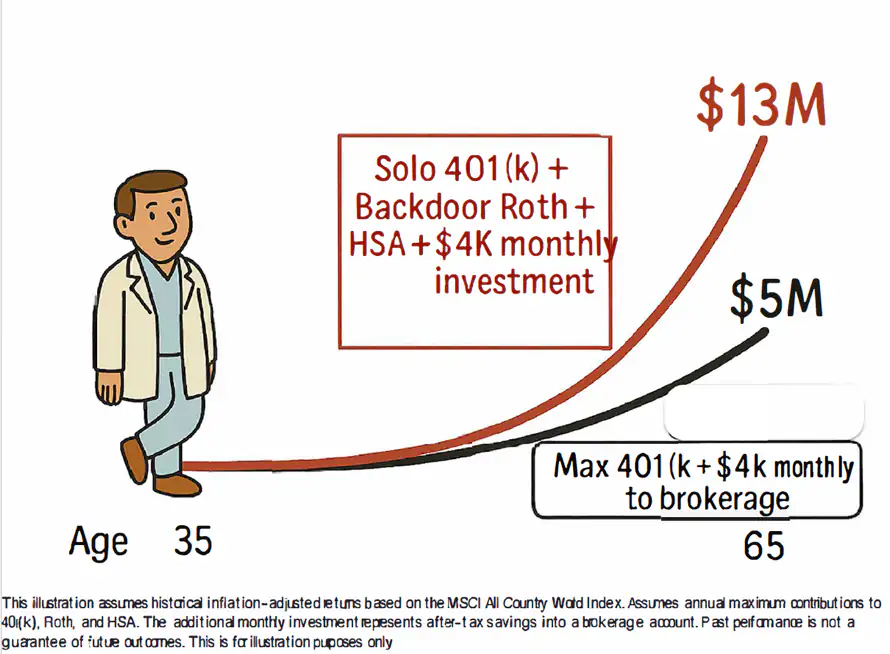

Let’s make this concrete on what progress looks like for doctors:

None of this is magic. It’s just structure—aligned to your real life, not someone else’s model.

The feeling of being behind? It’s powerful. But it doesn’t mean you’ve failed.

In fact, it’s often a sign that you’re ready for more intentional planning. And that you’re finally in a place—with income, stability, and perspective—where that planning can stick.

You’ve probably done more right than you realize.

You don’t need a complicated plan, you just need clear goal and a plan to get there.

This paper won’t answer every question. But maybe it helps you ask better ones.

Like:

You don’t need to do everything at once. You just need to get moving in the right direction.