All About Rewards

So far, in Part 1 and Part 2 of our “Risk Tolerance and Holding Individual Stocks” series, we’ve talked only about risks of holding individual stocks. The truth is, despite those risks, there may be good reasons to hold individual stocks in your portfolio, just like there may (sometimes) be good reasons to wrestle a Bobcat1 (Look to article one of this series).

Long-Term Capital Gains

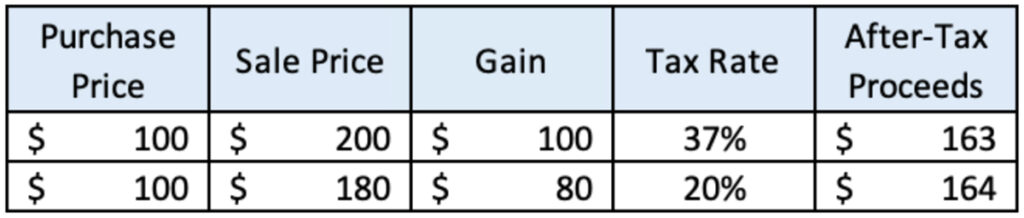

The most obvious reason is taxes. Let’s say you bought a stock 51 weeks ago for $100 per share, and it’s now worth $200 per share. If you sold it at 51 weeks, you would pay short-term capital gains taxes on the $100 gain, where the top tax rate can be as high as 37%. That means you’d pay $37 in taxes and be left with $163 after the sale.

But, say you waited only a couple of weeks more. Now, since you’ve held the stock for more than 1 year, you’re subject to much lower long-term capital gains tax rates, the highest of which is 20%. If the value of the stock was unchanged, you’d end up paying $20 in taxes, and be left with $180 after the sale.

But, even if you knew the stock price was going to fall, you may be better off holding it for the lower tax bill.

In the example above, you can see that even if the stock price fell 10% over those two weeks (from $200 to $180), you’d still end up with more money by waiting for long-term capital gains treatment.

Principle #5: Long-term capital gains rates2, which are available after holding a stock for one year, are highly beneficial. Holding off on selling stock until qualifying for these rates can be a powerful reason to temporarily accept the risks of holding individual stock. This situation can often arise through stock-based compensation plans.

Lower Tax Brackets

Using similar logic as above, there may be opportunities where delaying the recognition of gains3 until a later tax year (where your overall income is lower), may push you into a lower tax bracket. So, by gaining a better understanding of your future expected income, and being smart about controlling your taxes, the tax savings may be large enough to warrant holding individual stock longer.

Principle #6: Tax planning and investing go hand in hand. Having a thorough understanding of potential future income may provide opportunities to pay lower taxes, which may justify holding individual stock positions until future tax years.

Sources:

- https://castlepointwealth.com/risk-tolerance-and-holding-individual-stocks/

- https://www.nerdwallet.com/article/taxes/capital-gains-tax-rates

- https://www.irs.gov/taxtopics/tc409

The content of this article is developed from sources believed to provide accurate information. The information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. All expressions of opinion are subject to change. This content is distributed for informational purposes only, and is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products or services. Past performance is not a guarantee of future results. Index performance does not reflect the expenses associated with the management of an actual portfolio.