Would you wrestle a bobcat?

For reference, Bobcats are about 4 feet long and weigh up to 40 pounds.

If you don’t know what I’m talking about, here’s a link to the Wikipedia page1 and a picture (which, if you’re interested, you can actually buy for yourself!2).

Now, this may seem like a silly question. Why would you want to wrestle a Bobcat? What good could possibly come from that situation?

Well, what if the Bobcat had a hold of your niece or nephew? Or your pet? Or someone else’s pet? Or, just some nameless wild muskrat, as pictured above?

What if you were wearing thick leather clothing impervious to the Bobcat’s sharp teeth and claws?

At this point, you may be wondering if you clicked the wrong link and are no longer reading an article written by an investment professional. But hang with me.

I bring up the Bobcat situation for two reasons:

- Most times in life, when faced with a situation that involves risk (e.g., Bobcat wrestling), the risk is not the only thing worth thinking about. Whether or not a risk is worth taking usually depends on the potential benefits involved (e.g., saving your nephew). And the benefit is often subjective (e.g., you may be more game to wrestle for your pet than someone else’s).

- Risk itself is subjective. What if you are a strapping young man in your 20s that regularly hits the gym and is equipped with protective leather clothing as noted above? You’re likely much less susceptible to injury than a less strapping, less gym-frequenting individual dressed in business casual attire (such as myself).

Now that we have established that the appropriateness of risk-taking is based on the related benefits and that the magnitude of both risks and benefits can be both subjective and context-dependent, we’re ready to tackle the main topic of this article: holding individual stocks.

All About Risk

Stocks are risky assets.

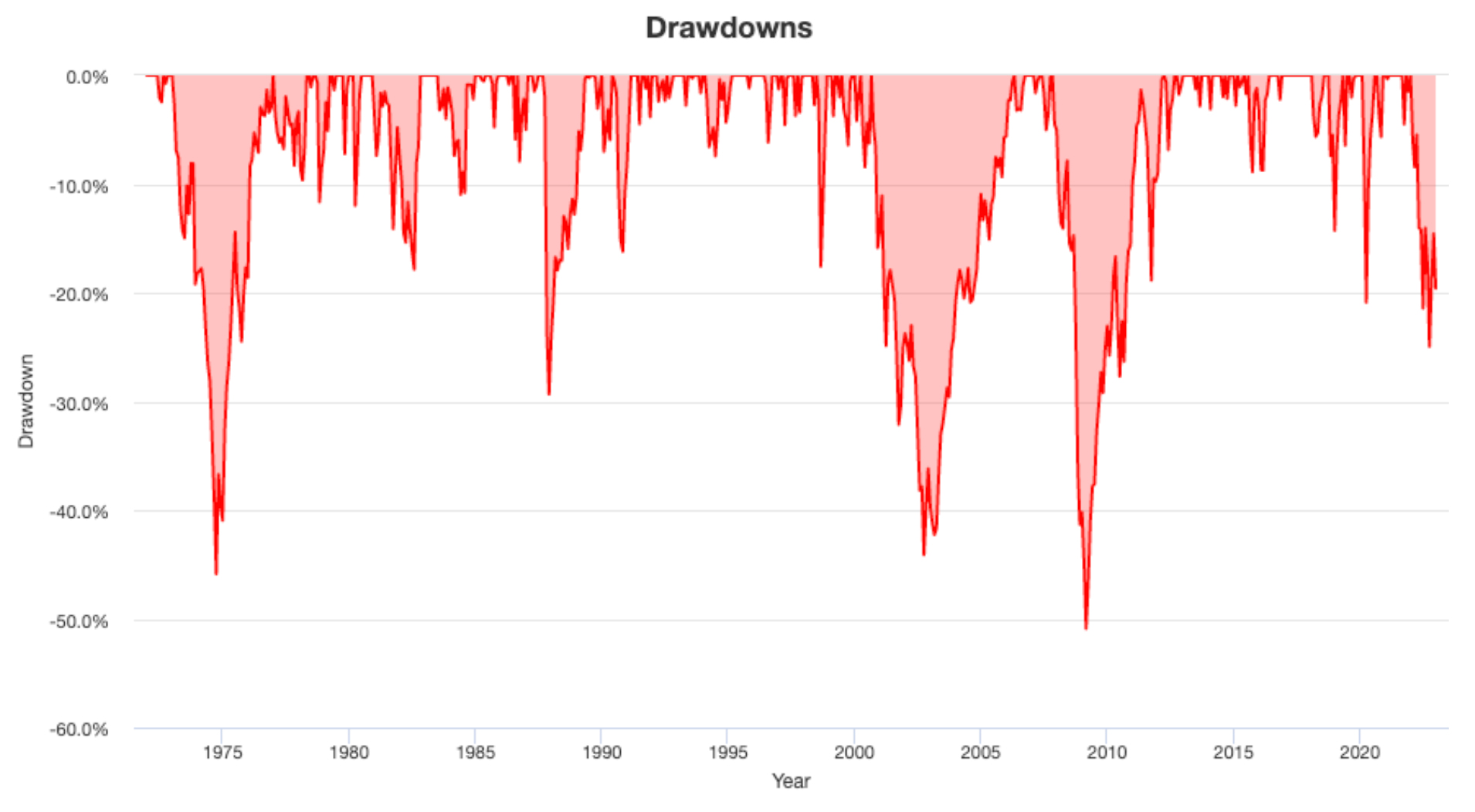

I am not breaking new ground here by saying stocks are risky assets. Looking at the last 50 years of data on the US stock market, we can see the stock market as a whole has been subject to very large drawdowns:

More than once, the stock market lost over 40% of its value3.

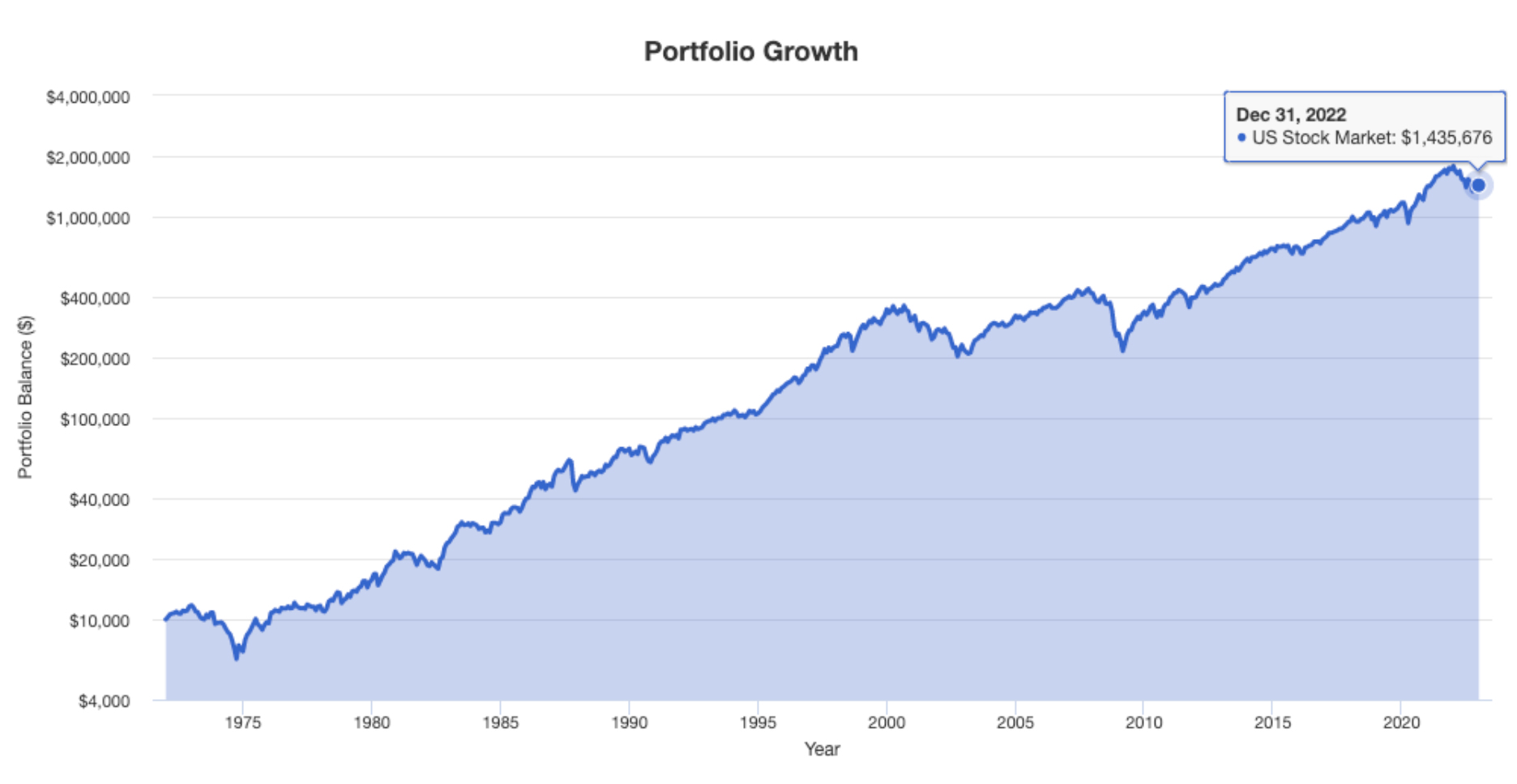

But, from that same dataset, we can see the silver lining. In spite of numerous periods of turmoil, the stock market as a whole has been a massive wealth-creation machine:

So, like wrestling a Bobcat, there is risk involved in stock market investing. The market experiences many periods over which asset values decline. But, historically, the benefit of taking those risks has been very, very large. Studies indicate long-term stock returns in the US have been about 10.1% per year, which is 6% more than “risk-free” investments like US treasury bills.4

But, what about individual stocks?

Here, the story takes a turn.

Historically, most stock investments lose money. That’s right: slightly over half of US stocks have historically lost money.

But didn’t I just tell you that stocks have been a historically great investment over time?

To explain myself, let’s imagine that you, Michael Jordan (who coincidentally purchased a stake in the Charlotte Bobcats in 2010), and I are trapped in an elevator. We push the “emergency” button, and as emergency services rush to the scene to free us, the operator tries to get a better understanding of the situation.

Riding MJs coattails, we tell the operator, on average, the occupants of the elevator have won 2 NBA championships each (precious cargo!). This is technically true: MJ has won 6 championships, there are 3 people on the elevator, and 6/3 = 2.

But, if you were to put our names in a hat, what are the chances you would draw the name of someone that has NOT won an NBA championship? Two of the three of us haven’t won championships: 2/3 = ~66%. So, while on average the elevator occupants have won multiple NBA championships, most of us haven’t. The same is true for stocks and the stock market. And, we even have a name for this type of concentration: it’s called skew.

Let’s talk more about the odds.

We’ve already established that more than half of US stocks have lost money in the long run. That means that, if you bought a random stock and never sold it, the most likely outcome will be that you will lose money. This fact alone should convince us to approach stock picking with some caution: while investing in the entire stock market has historically been a winning proposition, investing in a single stock has historically been a losing one.

But the story gets even worse: only 42.6% of individual stocks have outperformed “risk-free” US government T-bills. 5

And only 30.8% of individual stocks outperformed the total US stock market.5

That means that, if you were to pick an individual stock at random and hold it for the long term, you would underperform the US stock market almost 7 out of 10 times.

Those are bad odds for stock picking! And that leads us to our first conclusion about individual stocks:

Principle #1: If you’re going to hold an individual stock instead of a diversified portfolio, you better have a good reason to do that, because the odds are stacked against you.

But, what if, for one reason or another, you have decided you’re going to hold an individual stock in your portfolio? What should you consider?

How much?

The first question to ask about an individual stock position is: how much of it do you have? You may answer this question relative to your portfolio, i.e., “I have 10% of my portfolio in my employer’s stock.” The answer to this question can help you start to understand how much additional risk you are introducing to your portfolio.

But a better question to ask is, how much of your future living expenses do you plan to fund with this individual stock position? This requires more in-depth financial planning but really is the key step in assessing risk.

As you may guess, the smaller an individual stock position is relative to either your portfolio or your future spending needs, the less risky that holding is. Unfortunately, it’s tough to move beyond that generalization without developing an individualized plan.

This leads us to our second conclusion about individual stocks:

Principle #2: The size of the individual stock holding is important. Size relative to your other assets can be a good starting place, but the only real way to assess the size is to develop a long-term financial plan.

That’s not where the principles end, but it is where our article ends today. We’ll be continuing to outline additional principles over the next few months, including how to build a plan around your individual stock holdings, so stay tuned!

Sources:

- https://en.wikipedia.org/wiki/Bobcat#Importance_in_human_culture

- https://www.wayfair.com/Global-Gallery–Bobcat-Capturing-Muskrat-in-the-Winter-Idaho-by-Michael-Quinton-Framed-Photographic-Print-on-Canvas

- https://www.portfoliovisualizer.com/backtest-asset-class-allocation

- https://deliverypdf.ssrn.com

- https://deliverypdf.ssrn.com

The content of this article is developed from sources believed to provide accurate information. The information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. All expressions of opinion are subject to change. This content is distributed for informational purposes only, and is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products or services. Past performance is not a guarantee of future results. Index performance does not reflect the expenses associated with the management of an actual portfolio.