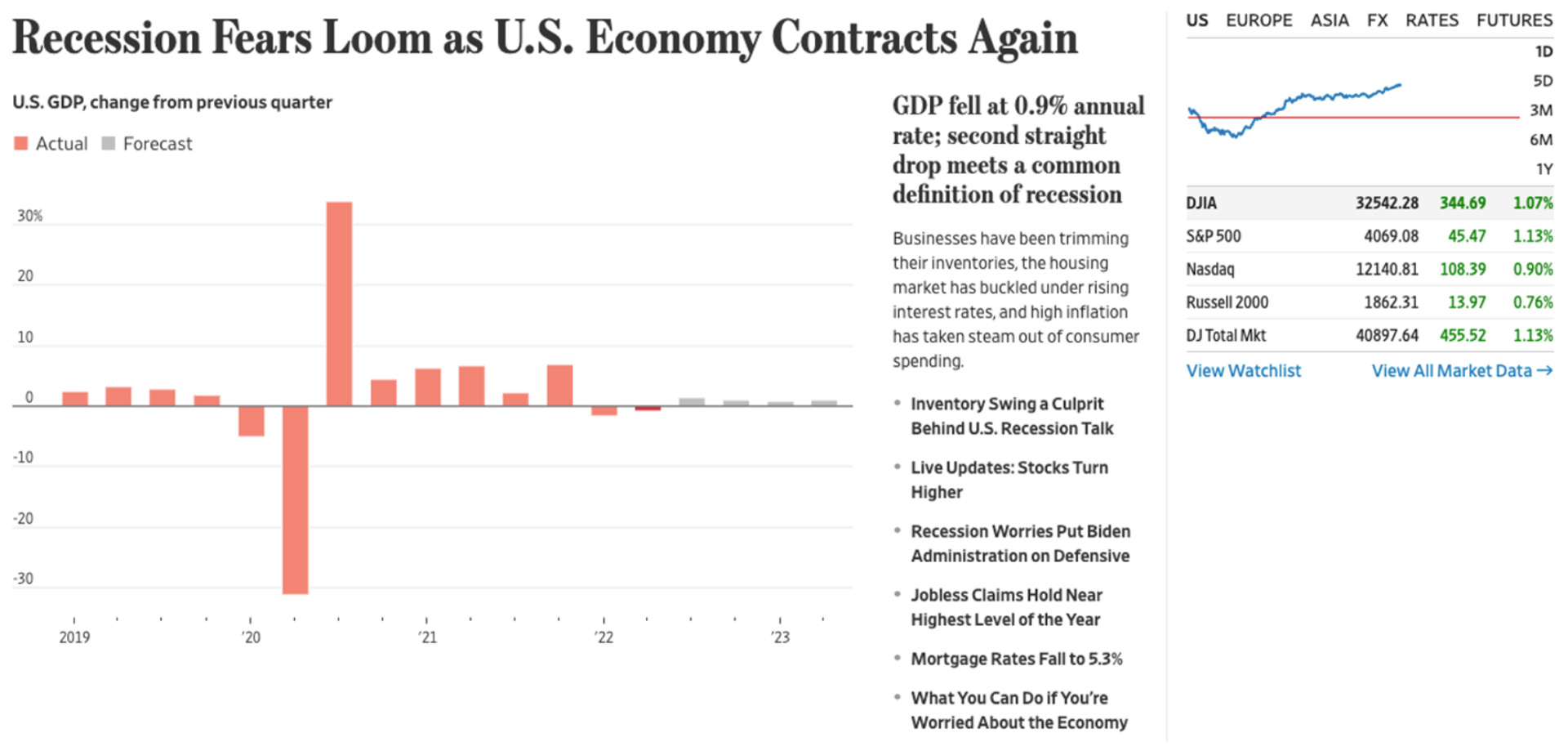

While perusing the Wall Street Journal, I saw something that perfectly illustrates a point that is often missed by even the most astute investors. Around 12:30 PM on July 28th, in a Wall Street Journal article, I saw this:

You may be wondering: what did I find so amusing about this picture?

Take a look at some of the headlines:

“Jobless Claims Hold Near Highest Level of the Year”

“GDP fell…second straight drop meets a common definition of recession”

“Recession Worries Put Biden Administration on Defensive”

“What You Can Do If You’re Worried About the Economy”

Surely, if all these bad things are happening, the stock market must be TANKING. Right?

Wrong. As you can see in the image above, the S&P 500 along with many other common stock market indices were up.

Not only was the market up in the midst of the seemingly dour news; it had rallied the day before as well,1 despite the Federal Reserve raising interest rates in May of 2022 in abid to slow economic growth.2

So, what gives? Why would the markets rally on bad news? What’s wrong with this picture? Are the markets delusional?

Actually, quite the opposite. The markets are calculating machines. They’re constantly evolving, incorporating the best information, estimates, and predictions of the future into the prices of stocks. Generally, markets don’t move on good news or bad news, but more often move on news being better or worse than expectations.

But, whose expectations are we talking about? Well… everyone! Market prices reflect the accumulated wisdom of all investors, many of which are very sophisticated, pouring over sophisticated and seemingly obscure data—including things as wild as satellite images—to get slightly clearer picture of what the future might hold.3

For a more relatable example, think back to the great toilet paper shortage of 2020. News media across the country were sounding the alarm: toilet paper hoarding was creating shortages and driving prices up across the country.4 While you may not have locked and loaded before your trip to the store like this man did5, I bet you were aware this was happening, and made sure your purchasing habits ensured a steady supply of TP for you and your loved ones.

While toilet paper doesn’t trade on the stock market, the exact same phenomenon is at work. Buyers and sellers are looking toward the future, and prices are adjusting to meet their collective expectations.

Still, the toilet paper metaphor might leave you slightly unnerved. Is it really true that a short-sighted, unpredictable, mass hysteria could leave you without any TP? Or, as an investor, with a catastrophically diminished account balance?

Fortunately, as a long-term investor, you have a superpower: most of your investments will not be needed for multiple years, even decades, at which time most of today’s “bad news,” and the resulting market impact, will be little more than a historical footnote, relegated to the depths of boring conversations among nerdy investment professionals like me.

I hope you really take your superpower to heart. Having a long-term focus is truly special and unique.

Many investors are playing a totally different game. They’re trading for short term profits, taking on highly concentrated and speculative positions in individual companies, or borrowing gobs of money to pour rocket fuel on their short-term bets. When markets hit a rough patch, many of these investors have great reasons to be fearful. Even temporary declines can push them past the breaking point, leaving them penniless or even indebted. Tragically, as these short-term investors begin to panic and cut their losses, many long-term investors get swept up in the emotions of the moment, temporarily losing sight of their long-term plan and sabotaging their future by cashing out at a uniquely poor time.

To bring it back to our toilet paper analogy: the short-term investors are down to their last roll. They have reason to worry. They’re the ones getting in fist fights at the grocery store.

I don’t know if you personally made it through the great toilet paper shortage unscathed. But, I can give you some reassurance about making it through the current market turbulence. You, as a long-term investor, are sitting on a throne of toilet paper. You don’t need to monitor the daily inventory levels of TP at your local grocery store, just like you don’t need to monitor the daily headlines and resulting movements of the stock market—neither are relevant to your long-term plan.

Instead, you can rise above the toilet paper scrum, and rise above the short-term market machinations. From a position of strength on your toilet paper throne, you can ride the wave of long-term economic growth6 to a happy, abundant, toilet-paper-rich life.

Sources:

- https://finance.yahoo.com/news/stock-market-news-live-updates-july-27-2022-113235652.html

- https://www.bloomberg.com/news/articles/2022-05-04/powell-vows-to-curb-inflation-with-hikes-that-risk-economic-pain (“cooling demand” is a more technical term synonymous with slowing economic growth)

- https://www.theatlantic.com/magazine/archive/2019/05/stock-value-satellite-images-investing/586009/

- https://www.businessofbusiness.com/articles/toilet-paper-prices-are-up-confirming-were-hoarding-it-again-as-covid-cases-jump/

- https://www.usatoday.com/story/money/2020/04/08/coronavirus-shortage-where-has-all-the-toilet-paper-gone/2964143001/

- https://castlepointwealth.com/when-to-buy-stocks-in-a-hot-market/

Sources for image used:

https://www.wsj.com/articles/us-q2-gdp-growth-economy-11658981184

Index stamps:

https://finance.yahoo.com/chart/%5EGSPC

The content of this article is developed from sources believed to provide accurate information. The information is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. All expressions of opinion are subject to change. This content is distributed for informational purposes only, and is not to be construed as an offer, solicitation, recommendation, or endorsement of any particular security, products or services. Past performance is not a guarantee of future results. Index performance does not reflect the expenses associated with the management of an actual portfolio.